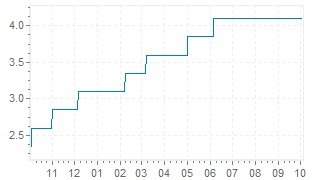

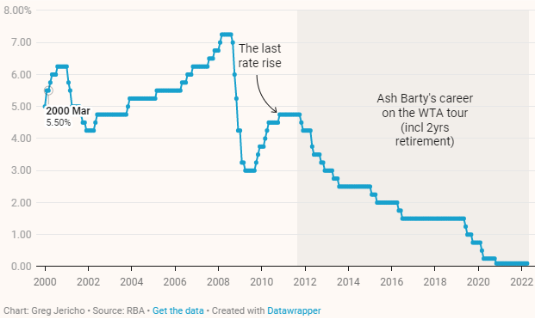

RBA interest rate

What is the Economic Calendar. Graph Australian interest rate RBA - long-term graph.

Rba Official Cash Rate Ocr Australian Central Bank S Current And Historic Interest Rates

Mr Aird said the RBA could shift to business as usual monthly increases of 25 basis points from here if the upcoming economic data particularly on wages made that case.

. The amount of interest a retail investor pays on a loan is equal to this rate plus a premium which is the banks profit and typically 20 to 25. The cash rate is the interest rate on unsecured overnight loans between banks and other lenders. RBA For more details see Statistical Table F6 Housing Lending Rates and Statistical Table F7 Business Lending Rates.

Cash Rate Target. Typically they have been moving in line with the RBA cash rate meaning your variable rate home loan could be increasing by another 50 basis points. The Reserve Bank of Australia has raised interest rates by 05 percentage points making the new cash rate 135 per cent.

Eleven times a year the RBA meets to decide whether the cash rate should go. A media release is issued at 230 pm after each Reserve Bank Board meeting with any change in the cash rate target taking effect the following day. Macquarie Bank which is the nations fifth largest lender was the first bank to lift its.

A Includes loans at variable and fixed interest rates Sources. Fixed rate borrowers will be rolling off an average fixed rate mortgage of around 225 per cent onto a rate around 45-5 per cent in 2023 based on our forecast profile for the cash rate he. 1 day agoThe unrelenting pace of Reserve Bank interest rate rises is getting dangerous and the RBA risks repeating past mistakes and inflicting unnecessary pain on Australians.

Prior to December 2007 media releases were issued only when the cash rate target was changed. Lets say you have a 1 million mortgage and there are five or six rate hikes from the RBA taking the cash rate to 175 per cent. The RBA Cash Rate Target is what people commonly refer to as the current interest rate.

The cash rate is actually the interest rate charged on overnight loans between banks. RBA reveals jobless rate prediction The Reserve Bank of Australia has released its latest economic assessment with a surprising prediction about wages growth. FXStreets real-time Economic Calendar covers economic events and.

The August increase marks the first time the RBA has lifted interest rates at four consecutive meetings since it started announcing its desired level for the cash rate in. The headline annual inflation rate in Australia rose to 61 per cent in the second quarter from 51 per cent in the first but did come in slightly below the 62 per cent expectation. Thats the third rate rise in three months.

CBAs base case is a further 50 basis point hike in September a pause in October and a final hike of 25 basis points in November taking the cash rate to a peak of 26. The current Australian interest rate RBA base rate is 1850. The RBA raised its policy rate by 50 bps on Tuesday to 185 - its fourth consecutive hike and the steepest in nearly 30 years.

RBA Interest Rate Decision. RBA cash rate Are interest rates going up or down. The RBA hiked the cash rate by 50 basis points on Tuesday bringing the cash rate to 185 per cent.

Already under fire after. Australias central bank has triggered a third interest rate hike in as many months imposing a 50 basis point increase which lifts the official cash rate from 085 to 135. Inflation in Australia has increased significantly.

But thats done little to lift AUDUSD which was down by nearly. The cash rate is set by the Reserve Bank of Australia RBA and affects the interest rates banks charge their customers as well as the rates of interest paid on savings accounts and term deposits. At its meeting today the Board decided to increase the cash rate target by 50 basis points to 85 basis points.

RBA Interest Rate Decision is announced by the Reserve Bank of Australia. The latest RBA rate increase means a homeowner paying off an average 600000 mortgage will have to find an additional 169 for their monthly mortgage repayments as they climbed to 2827 from. The RBA has now lifted the cash rate by 175 basis points since May when it started the tightening cycle with a business as usual 25 basis point hike from a record low 01.

Reserve Bank of Australia The Reserve Bank of Australia RBA is the Australian central bank. If the RBA is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive or. Check your current interest rate.

Stay on top of the RBAs monthly cash rate decisions with predictions and insights from 40 experts. It also increased the interest rate on Exchange Settlement balances by 50 basis points to 75 basis points. RBA interest rates decision.

The aim of this policy is to achieve low and stable. The RBA changing or communicating a future change to official rate targets can have a material impact on domestic bond yields like 10-year AGBs. The RBAs most important task is to set the monetary policy for Australia.

In an announcement made after their monthly board meeting the Reserve Bank of Australia has raised the cash rate to 185. RBA rate decisions are made by its Reserve Bank Board. Monetary policy decisions involve setting a target for the cash rate.

That person will have to pay an extra 885 per month. The RBA increased interest rates by 050 on Tuesday bringing the cash rate to 185 Top economists at the ASX 200 banks forecast rates to reach 260 to 285 by the end of 2022.

Your 10 Second Guide To Today S Rba Rate Decision

Rba 2022 Interest Rate Forecast Bad News For Property Market

Rba Official Cash Rate Ocr Australian Central Bank S Current And Historic Interest Rates

Comments

Post a Comment